In this Blog, I want to tackle a topic that has been in the back of my mind for very very long. I suspect it has been on the back-burner for many of you too.

Annuities!!!

I can pick a random person of any age and I am quite sure they would have heard about Annuities. Younger folks in their 20’s and 30’s tend to be less pursued by Annuity Agents. Folks of a certain age (Ahem!! 40 and above, tend to get relentlessly pursued to invest in Annuities. There are many nuances and reasons one can get badgered by the Annuity industry. In all cases, the prime reason is that it is a huge Money-Maker for everyone selling it. It is after all the subsidiary of the Insurance Industry.

Don’t get me wrong. There are many aspects about Annuities that may make it a desirable financial vehicle for many folks. Aspects such as the following…

- Annuities could be Exempt from probate.

- Annuities could provide protection from creditors.

- Annuities could provide protection from outliving one’s income.

- Annuities could provide unlimited tax deferrals without any contribution limits.

But then, I look at the way Annuities are aggressively pushed and I want to question if it is a desirable financial vehicle for everyone! There are many individuals as well as independent financial advisors who are financially savvy and understand how Annuities are designed. They can build well diversified portfolios with individual securities, to duplicate the results of Commercial Annuities in many respects (i.e. the Commercial Annuities offered by insurance carriers).

My own Annuity saga started when I recently got the quarterly statement for my 401k portfolio. On the last page, there was this seemingly innocuous plug (solicitation) to invest in Annuities that were sold by the Fiduciary company. I stared it at for quite a while, imagining my future as a crippled man waiting for my annuity check each month. I read and re-read it multiple times, until the terms began to sink in. Of course the plug was seemingly hypothetical. The company made it sound like an amazing once in a lifetime great deal. I tend to get really agitated and irritated when grand numbers are thrown at me and I have no clue how those numbers came about. I want to know how it works!! I want to play with the possibilities!! I felt it was time to plug these numbers into a spreadsheet to see if and how it could make sense. If you are like me and want to know, I invite you to follow along. Follow along to see if these calculations make sense to you too. I am not offering any “Advise”. I am just showing my calculations and asking dumb questions. Do your own math. Don’t nit-pick the small stuff but try and see the bigger picture. BTW, a very wise elder once told me, “The only dumb question is the one that was never asked!!”

So the solicitation in the quarterly statement indicated that my account balance is around $168,753 as of December 31, 2023. The Fiduciary company(the one that was pitching the Annuity to me) was giving me estimates of how much money I could receive each month, if I were to receive payments as a Single Life Annuity. In this arrangement, I would be paid a fixed amount of money ( around $1089, starting at retirement) each month, for the rest of my life. They proceeded to say that following my death, no further payments would be made to my spouse or heirs. The payments were based on the following assumptions.

- The estimated monthly payments begin December 31, 2023.

- I am 67 on this date (which I am not, I have many years before retirement. This company knows exactly how old I am, so this assumption is ridiculous!! You will likely understand why they do this as you read on…)

- If I were younger, the monthly payments would be lower than $1089, since payments would be made over more years. (Ya, I have no clue why!! Aren’t they going to invest this amount? To let it grow until I am 67 and *then* begin to withdraw? Again, they know exactly how old I am so why play these games???)

- If I were older, the monthly payments would be higher than $1089, since they would be made over fewer years. (Okay, that makes sense because as a male in decent health, I would reasonably be expected to live until I am 77yrs old. So the total withdrawal months would be lesser. What a generous and honest company, really!!)

- The Payments are based on an interest rate of 4.22%. This is the 10-year constant maturity US Treasury securities yield as of Dec 1, 2023.

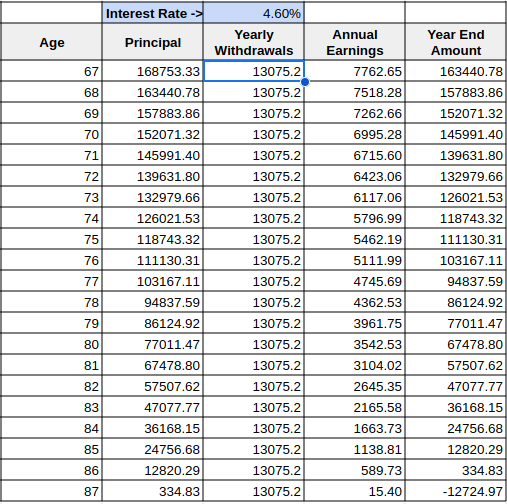

I took these metrics and plugged them into a spreadsheet. Basic compound Interest calculation, with @4.6% interest will yield me $13075 annually (i.e. $1089*12). Per these calculations, the money I gave to the company selling me the Annuity, runs out on my 87th birthday. They make out if I die at 77yrs (i.e. average American Male mortality. I bet they are betting on this, or earlier). I make out, if I live 87yrs and beyond. Insurance companies are traditionally very conservative and rich. They really know what they are doing. Besides they are in this game to make money. They are not in it for charity. Lets see what the numbers say…

I tried a few free Annuity Calculators on the Internet. Their outcomes were more or less similar to mine. Note that I showed the 87th year just for illustrative purposes. The last breakeven payment for the company selling the Annuity would be made on Dec 1, of my 86th year. After that, i.e. if I live longer, I win and they make losses each month. Ya, you guessed it!! That rarely happens!!

So, simple and straightforward, right? My account balance on Dec 31, 2023 was around $168,753. If I were to invest this amount into this proposed immediate annuity today(Jan 1, 2024), assuming I am 67 today, I would receive $1089.60 monthly.

$1089.60 give or take, based on an interest rate of 4.6%, which is close to the 4.22% interest rate of the 10-year constant maturity US Treasury securities yield rate as of Dec 1, 2023.

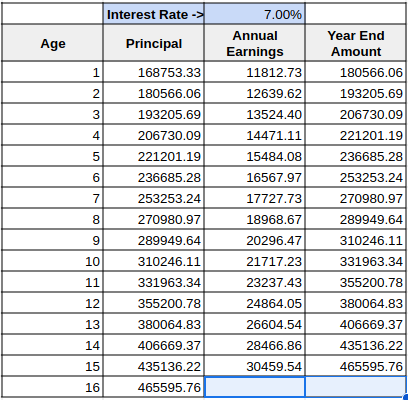

So using the same reasoning as shown above, let’s see what happens if most of the same parameters are used, except, we assume that retirement age is say 15yrs away (i.e. no withdrawals until retirement). We will also assume that the money is invested in a well diversified portfolio. My own diversified portfolio has returned an average of 7% (annualized) over many years (Note: past performance is not a guarantee for future results!). So what happens on Jan 1 of year 16, when one turns 67 and retires? We use the same compounding calculations as above, except no withdrawals this time. The money is just supposed to grow over time.

The portfolio begins with $168753, compounds annually at a rate of a modest 7% and ends up appreciating to $465595. It would be more, if the interest rate was higher. Heck, even at the 4.6% interest rate, the portfolio ends up appreciating to $331304 in 15 years. So in reality, $465595 (and NOT $168753 as the Annuity company was telling me!!) is really the amount one should be working with, to figure out withdrawal at retirement. Are you with me so far??

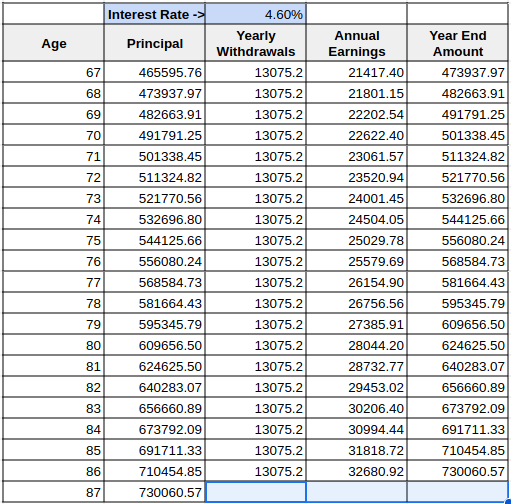

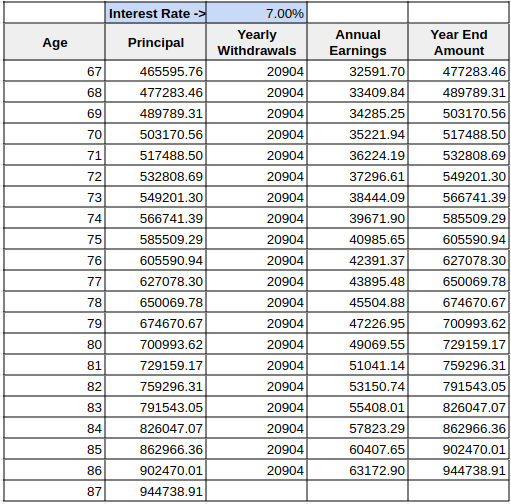

Next, lets take the $465595 amount at the end of year 15. Say one is 67yrs old by then, and apply it to that annuity spreadsheet. Yes, the same annuity spreadsheet we created, waaaaay up top. Other than the start amount, lets keep everything else the same for comparison sake.

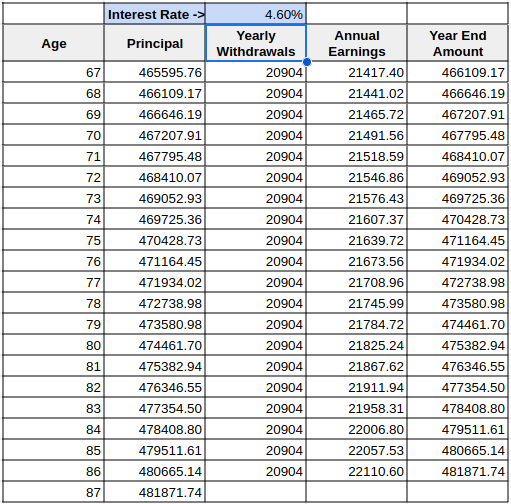

Wow!!! At a $1089 monthly($13075 annually) withdrawal rate beginning after retirement, in 15 years, the portfolio actually keeps growing. This is with the 4.6% US Treasury security rate. I could really withdraw right up to the portfolio earnings, i.e. 4.6% or $1784 to maintain the portfolio at the same balance. Let’s withdraw a lower amount, say $1742 monthly($20904 annually), instead of $1089. Same table as above, just different withdrawal amounts.

Holy Cow!! In 15 years, one could withdraw $1742 monthly (i.e. $20904 annually) and the portfolio would keep chugging ahead endlessly. Of course, as long as withdrawals are less than earnings, I can dream of passing this on to my beneficiaries!!! This is getting exciting now. What happens if the money continues to be invested in a well diversified portfolio, with an average annual return of 7%? Withdrawal continues to be $1742 monthly (i.e. $20904 annually).

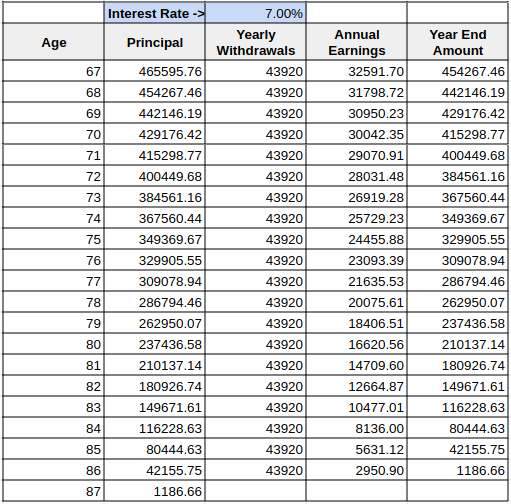

Almost a million dollars when one is 87yrs old!!! Beginning with $465595 at retirement, with a $1742 monthly withdrawal rate and 7% return on investment, one ends up with almost a million dollars!!! Now this is the calculation that surprised me. So at this 7% annual rate of return, what amount can one expect to withdraw, so that the balance at 87yrs of age is drawn down to 0?

Well, close to 0!! One can withdraw $3660 monthly ($43920 annually).

At this point I have to ask “Why was this company, that was trying to sell me this annuity, giving me such a low-ball withdrawal estimate of $1089, for when I am 67yrs?? Why were they using $168753 as a basis of their calculations?? Why??” Are these mind tricks? Are these Optical Illusions designed to daze and confuse? I am not sure. But I suspect it is because not many individuals do a deep dive to figure this out. Besides, it is a well known bargaining strategy to start with a very low basis. That way, any concession above that low basis seems magnified and huge.

All that said, Annuities can be good retirement vehicles for certain individuals. It could possibly provide a guaranteed rate of return, which can make certain individuals feel safe. That is just fine. Just make sure that you hire a good independent financial advisor, to read over the fine print and make sure you really understand what you are signing up for. DIY investing is not everyone’s cup of tea. It takes a lot of restraint and lots of discipline. The payoff, as you can see in the above tables, can be very robust. (Note: past performance is not a guarantee for future results!)